Addictive Metrics: Understanding the Allure of Short-Term Gains

Estimated Reading Time: 10 minutes

Key Takeaways

- Understanding the pull of quick, short-term profits and its effect on trading habits.

- Key decision-making strategies for resisting the impulse of immediate gains.

- Importance of setting personal policies to resist harmful trading practices.

- The role of consistency in effective trading strategy.

- Developing comfort with market volatility to enhance trading performance.

Table of Contents

- Addictive Metrics: Understanding the Allure of Short-Term Gains

- Harnessing Your Impulse: Key Decision-Making Strategies

- Re-Inventing the Trader’s Toolkit: Starting with Personal Policies

- Trading Rhythm: Establishing Consistency in Your Practice

- Embracing the Unpredictable: Developing a Tolerance for Market Volatility

Addictive Metrics: Understanding the Allure of Short-Term Gains

Many traders find themselves enticed by the appeal of quick, short-term profits, not unlike the pull of a slot machine at a casino. This seductive pull is one aspect of the gambling mindset in trading, where the thrill of an immediate reward outweighs longer-term, strategic planning. source By understanding the allure of these ‘addictive metrics,’ you can take the first step towards a more sustainable, disciplined approach to trading. source

Harnessing Your Impulse: Key Decision-Making Strategies

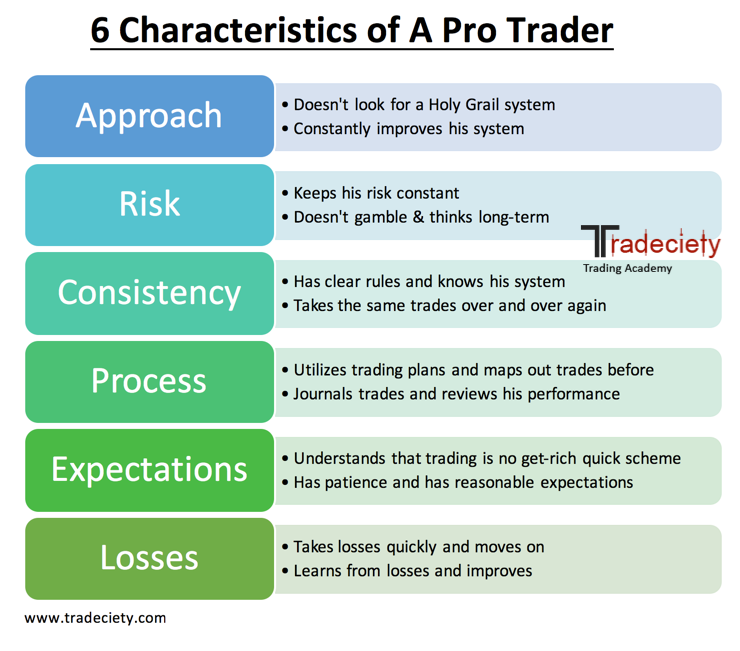

Impulsivity lies at the heart of the casino mentality in trading. Harnessing the impulse to chase immediate gains can be challenging – but it’s not impossible. Key decision-making strategies like thorough market analysis, employing patience, and cultivating a discipline for long-term gains can significantly help curb this impulse. source source

Re-Inventing the Trader’s Toolkit: Starting with Personal Policies

A crucial technique in resisting the gambler’s mentality in trading is setting strict personal policies. These could include ‘loss limits,’ beyond which you promise to stop trading for the day, or setting clear rules for when to exit a trade. source Essentially, these policies create a personal safety net, protecting you from falling back into impulsive, harmful trading habits. source

Trading Rhythm: Establishing Consistency in Your Practice

Consistency is an essential element of an effective, disciplined trading strategy. This involves regular evaluation of your trading performance, setting a routine trading schedule, and consistency in risk management. source Establishing a ‘trading rhythm’ can prevent you from succumbing to the highs and lows associated with more sporadic, gambler-minded trading tactics. source

Embracing the Unpredictable: Developing a Tolerance for Market Volatility

Lastly, an important part of overcoming the casino mentality in trading is developing comfort with market volatility. Market fluctuations are an inherent part of trading, and harnessing them to your advantage, instead of being intimidated by them, can boost your trading performance. source By adapting your trading strategies to include volatility as an ally, rather than an adversary, you can better resist the ‘dice-roll’ lure of the gambling mindset. source

FAQ

- What is the influence of mindset on trading?

- Why is long-term trading often more sustainable?

- How can analytics help in making effective trading decisions?

- Why are personal policies essential for safe trading?

- What role does risk management play in trading?

- Why is it important to develop a tolerance for market volatility?