With the increasing popularity of online trading, Muslims have been asking an important question: Is trading in the foreign exchange market halal or haram in Islam? Foreign exchange trading is considered an incredibly flexible and profitable trading system. However, in contrast to foreign exchange trading, which is basically driven by profit, Islamic finance is primarily motivated by ethical principles to maintain justice or justice and transparency.

The forex market deals with the exchange of money, and this has been going on for several centuries; there is nothing that specifically prohibits this practice within Islam. Where the actual problem can be found is not within the nature of the business that is conducted, but rather within the way that modern forex works. In order to see if this is a legitimate practice within Islam, one must consider the Ribā, Gharar, and Maisir aspects of Islam.

Islamic Scholarly Views on Forex Trading

There are no conclusive fatwas among Islamic jurists about forex trading. However, views differ according to the nature of the trade as well as how the incomes are generated.

Interest (Ribā) and Swap Fees

One of the most important considerations is dealing with interest. Forex accounts usually come with overnight swap or rollover fees, which are based on interest charges. Receiving and giving out interest is expressly prohibited under Islamic law. If a trader is engaging in such practices, then there is nothing else to determine because all of it is haram.

For this reason, many brokers began to introduce Islamic (swap-free) accounts for trading the Forex market without any interest charges. The brokers make their profit through spreads and/or fixed service charges. Some scholars find this acceptable as long as the charges represent the cost of service and not interest in disguise.

Ownership and Settlement Timing

For an exchange of currency to be considered valid in Islamic law, it has to involve immediate or constructive possession. For modern currency markets, transactions take place online and within seconds. While some jurists accept this as valid constructive possession, others see it as ambiguous, especially in delayed settlement. This goes to explain why different jurists have different opinions.

Forex Trading vs Gambling: Where Is the Line?

Too often, Forex trading is crucified as nothing more than gambling; often, this is fair, but not always.

If the trader enters the market only by guesswork, emotional decisions, or blind reliance on price movements, such an activity draws very close to gambling, which is forbidden in Islam. “A profit earned without effort, knowledge, and analysis, instead by chance, is considered haram.”

However, some scholars make a differentiation from gambling when the trade is informed by careful research, technical analysis, economic understanding, and risk management. Intention and methodology matter herein. When forex is treated like a casino, it becomes haram—even if an Islamic account is used.

Leverage and Margin: A Grey Area

Leverage gives traders the ability to trade large amounts with relatively small capital. Although this increases the potential profit, the potential loss is equally large.

Certain scholars frown upon leverage as it is close to borrowing cash for the benefit of the broker. Others permit leverage with stringent criteria if there is no involvement of interest and all the conditions are above board.

In terms of practicality as well as ethics, leverage fosters imprudent behavior, emotional trading, as well as excessive risk-taking, all of which oppose the values of moderation in Islam. Even if should leverage is within the boundaries of the Sharia-based rules, its abuse can easily convert trading into speculation.

So, Is Forex Trading Halal or Haram?

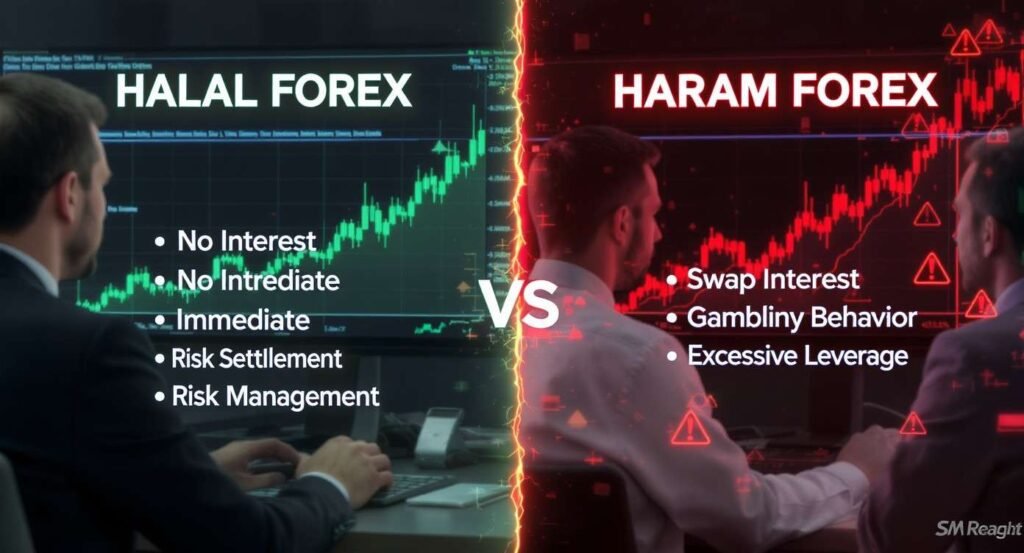

Forex trading cannot be classified as entirely halal or entirely haram. Its permissibility depends on whether specific conditions are met:

Forex trading may be considered halal if:

- No interest (ribā) is paid or received

- A genuine Islamic (swap-free) account is used

- Trading is based on knowledge, analysis, and discipline

- Speculation and gambling-like behavior are avoided

Forex trading becomes haram if:

- Interest is involved in any form

- Trades are placed recklessly or emotionally

- The activity resembles gambling rather than informed decision-making

Simplistic claims that forex is always halal or always haram fail to reflect the complexity of Islamic financial principles.

Is Forex Trading Actually Profitable?

Trading in the Forex market can be profitable, although it is a fact that a larger number of traders end up with losses. This is not due to any fraud in the market, but rather due to traders underestimating just how disciplined they need to be.

For lasting success, education, temperament, control of one’s emotions, and proper risk management are required. There will not be any quick profits.

From an Islamic viewpoint, the pursuit of unrealistic gains can fuel the desires of a trader, making him impatient, and what can seem like a good deed can turn into a cause of self-ruin. Forex trading needs to be a skill like any other, and not a way of making a quick buck.

Is Forex Trading Legal in the UK?

Yes, forex trading is legal in the United Kingdom. Forex brokers in the UK are required to be regulated by the Financial Conduct Authority (FCA), which regulates all transactions to promote transparency and consumer protection.

Nevertheless, the legality of the practice under the UK legal system does not necessarily make the practice halal. Yet, the forex trade may still not consider the Islamic practices, even though the trade might be legal.

Forex Trading for Muslims Living in the UK

Muslims in the UK have access to regulated brokers and Islamic account options, which removes many excuses for ignorance. However, responsibility remains with the trader.

A Muslim trader must:

- Verify that the Islamic account is genuinely interest-free

- Fully understand the broker’s fee structure

- Trade responsibly and ethically

- Avoid blind signal-following and greed-driven decisions

Using social media tips or copying trades without understanding contradicts the idea of halal trading.

Summary

Such dealings in foreign exchange activities are neither automatically forbidden nor allowed. Their permissibility is based on knowledge, intent, and performance of the fundamentals of Islamic financing.

People who are unwilling to learn, control risks, and comply with guidelines from Islam should never involve themselves in Forex trading. Most failures in Forex trading do not come from it being haram, but from improper conduct that does not comply with either financial rationale or Islamic morality.

With the right approach and attitude, proper Islamic values, and an Islamic structure of trade, the foreign exchange activity can be rendered permissible and profitable.

FAQs

Is forex halal in Islam?

Forex trading itself is neither halal nor haram by default. Its permissibility depends on whether interest, gambling, and excessive uncertainty are involved.

Is forex trading suitable for beginners?

Beginners are especially vulnerable to turning forex into gambling if they trade without knowledge or discipline. Education is essential.

Is forex profitable long-term?

Yes, but only for disciplined traders with realistic expectations. Most losses result from poor risk management and emotional trading.

Is forex legal in the UK?

Yes. Forex trading is legal in the UK through FCA-regulated brokers, but legality does not equal halal compliance.

Do Islamic forex accounts make forex halal?

Islamic accounts remove interest, which is a major step toward halal trading. However, traders must still avoid speculation, gambling, and unethical behavior.